The COVID-19 coronavirus pandemic has affected all of our lives exponentially, but it has hit our businesses communities particularly hard because of the mandated state-wide closures of all “non-life sustaining businesses”.

The COVID-19 coronavirus pandemic has affected all of our lives exponentially, but it has hit our businesses communities particularly hard because of the mandated state-wide closures of all “non-life sustaining businesses”.

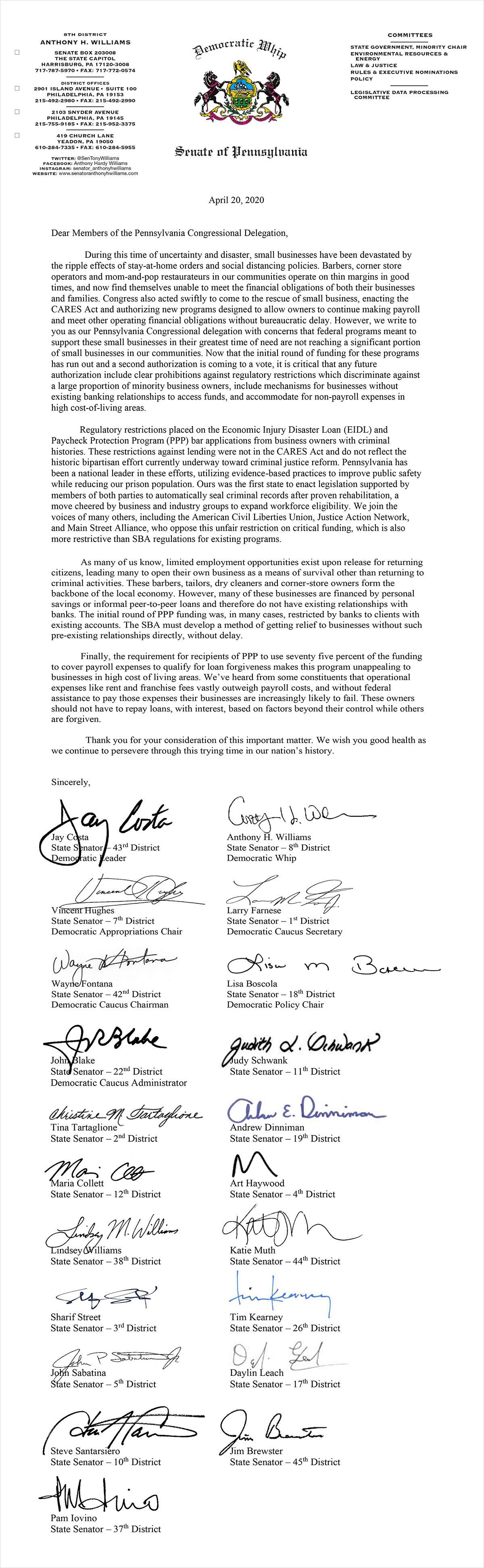

I sent a letter this week to the Congressional Delegation from Pennsylvania telling them that any future authorization of federal money for small businesses should include clear prohibitions against regulatory restrictions which discriminate against a large proportion of minority business owners, include mechanisms for businesses without existing banking relationships to access funds, and accommodate for non-payroll expenses in high cost-of-living areas.

The CARES Act authorized new programs designed to allow business owners to continue making payroll and meet other operating financial obligations without bureaucratic delay.

However, we’ve heard from some constituents that operational expenses like rent and franchise fees vastly outweigh payroll costs, and without federal assistance to pay those expenses their businesses are increasingly likely to fail. These owners should not have to repay loans, with interest, based on factors beyond their control while others are forgiven.

For businesses to survive this pandemic, they need easily accessible avenues to keep their businesses operational, and I call upon our Pennsylvania representatives in Congress to work for this aid for Pennsylvanians.