COVID-19 Information & Resources

Senator Williams hosts a Telephone Town Hall to discuss the How to Manage Diabetes during the COVID-19 Pandemic

Senator Williams hosts Telephone Town Hall to discuss educating children during the COVID-19 crisis.

Senator Williams hosts Telephone Town Hall to discuss housing and utility assistance in the era of COVID-19.

Senator Williams hosts Telephone Town Hall on Worker Rights and COVID-19.

Senator Anthony H. Williams hosts a Telephone Town Hall to discuss the Coronavirus (COVID-19) in PA

Senator Anthony H. Williams hosts a Telephone Town Hall to discuss the Coronavirus (COVID-19) in PA

LIVE daily briefings from the PA Department of Health:

pacast.com/live/doh or www.governor.pa.gov/live/ or watch on Facebook

Latest News

Department Of Health: Over 9.3 Million Vaccinations To Date, 52.7% Of Entire Population Received First Dose, 45.6% Of Pennsylvanians Age 18 And Older Fully Vaccinated, PA Ranks 10th Among 50 States For First Dose Vaccinations

Harrisburg, PA - The Pennsylvania Department of Health today confirmed as of 12:00 a.m., May 11, there were 2,385 additional positive cases of COVID-19, bringing the statewide total to 1,177,072. There are 1,798 individuals hospitalized with COVID-19. Of that...

Wolf Administration to Increase Indoor and Outdoor Events and Gatherings Maximum Capacity on May 17

The Wolf Administration today announced that event and gathering maximum occupancy limits will be increased to 50 percent for indoor events and gatherings and 75 percent for outdoor events and gatherings effective Monday, May 17 at 12:01 AM. “As more Pennsylvania...

Department Of Health Notes One More Step Required Before Pfizer-BioNTech Vaccine Approved For Use In 12-15 Year Olds

Harrisburg, PA - The Department of Health today applauded the U.S. Food and Drug Administration (FDA) for taking the next step to make Pfizer’s COVID-19 vaccine available to 12- to 15-year-olds, but noted one more important step is needed before vaccinations can...

Department Of Health: Over 9.2 Million Vaccinations To Date, 52.6% Of Entire Population Received First Dose, 45.3% Of Pennsylvanians Age 18 And Older Fully Vaccinated, PA Ranks 10th Among 50 States For First Dose Vaccinations

Harrisburg, PA - The Pennsylvania Department of Health today confirmed as of 12:00 a.m., May 10, there were 1,023 additional positive cases of COVID-19, in addition to 1,376 new cases reported Sunday, May 9, for a two-day total of 2,399 additional positive cases...

Department Of Health: Over 9.1 Million Vaccinations To Date, 51.9% Of Entire Population Received First Dose, 44.1% Of Pennsylvanians Age 18 And Older Fully Vaccinated, PA Ranks 10th Among 50 States For First Dose Vaccinations

Harrisburg, PA - The Pennsylvania Department of Health today confirmed as of 12:00 a.m., May 8, there were 2,610 additional positive cases of COVID-19, bringing the statewide total to 1,172,288. There are 2,012 individuals hospitalized with COVID-19. Of that...

Department Of Health Announces Free COVID-19 Testing Site In Pike County

Harrisburg, PA - The Department of Health today announced that a long-term outdoor drive-thru COVID-19 testing site will open to the public in Pike County at the Pike County Pennsylvania Welcome Center. The site is available through a partnership with AMI...

Department Of Health: Over 8.9 Million Vaccinations To Date, 51.6% Of Entire Population Received First Dose, 43.4% Of Pennsylvanians Age 18 And Older Fully Vaccinated, PA Ranks 10th Among 50 States For First Dose Vaccinations

Harrisburg, PA - The Pennsylvania Department of Health today confirmed as of 12:00 a.m., May 7, there were 2,986 additional positive cases of COVID-19, bringing the statewide total to 1,169,678. Please note, one lab is still getting caught up with backlogged data...

Department Of Health: Over 8.9 Million Vaccinations To Date, 51.2% Of Entire Population Received First Dose, 42.7% Of Pennsylvanians Age 18 And Older Fully Vaccinated, PA Ranks 10th Among 50 States For First Dose Vaccinations

Harrisburg, PA - The Pennsylvania Department of Health today confirmed as of 12:00 a.m., May 6, there were 2,476 additional positive cases of COVID-19, bringing the statewide total to 1,166,692. Please note, one lab is still getting caught up with backlogged data...

Department Of Health: Over 8.8 Million Vaccinations To Date, 50.9% Of Entire Population Received First Dose, 42.2% Of Pennsylvanians Age 18 And Older Fully Vaccinated, PA Ranks 10th Among 50 States For First Dose Vaccinations

Harrisburg, PA - The Pennsylvania Department of Health today confirmed as of 12:00 a.m., May 5, there were 2,597 additional positive cases of COVID-19, bringing the statewide total to 1,164,216 There are 2,172 individuals hospitalized with COVID-19. Of that...

COVID-19 Vaccine Information

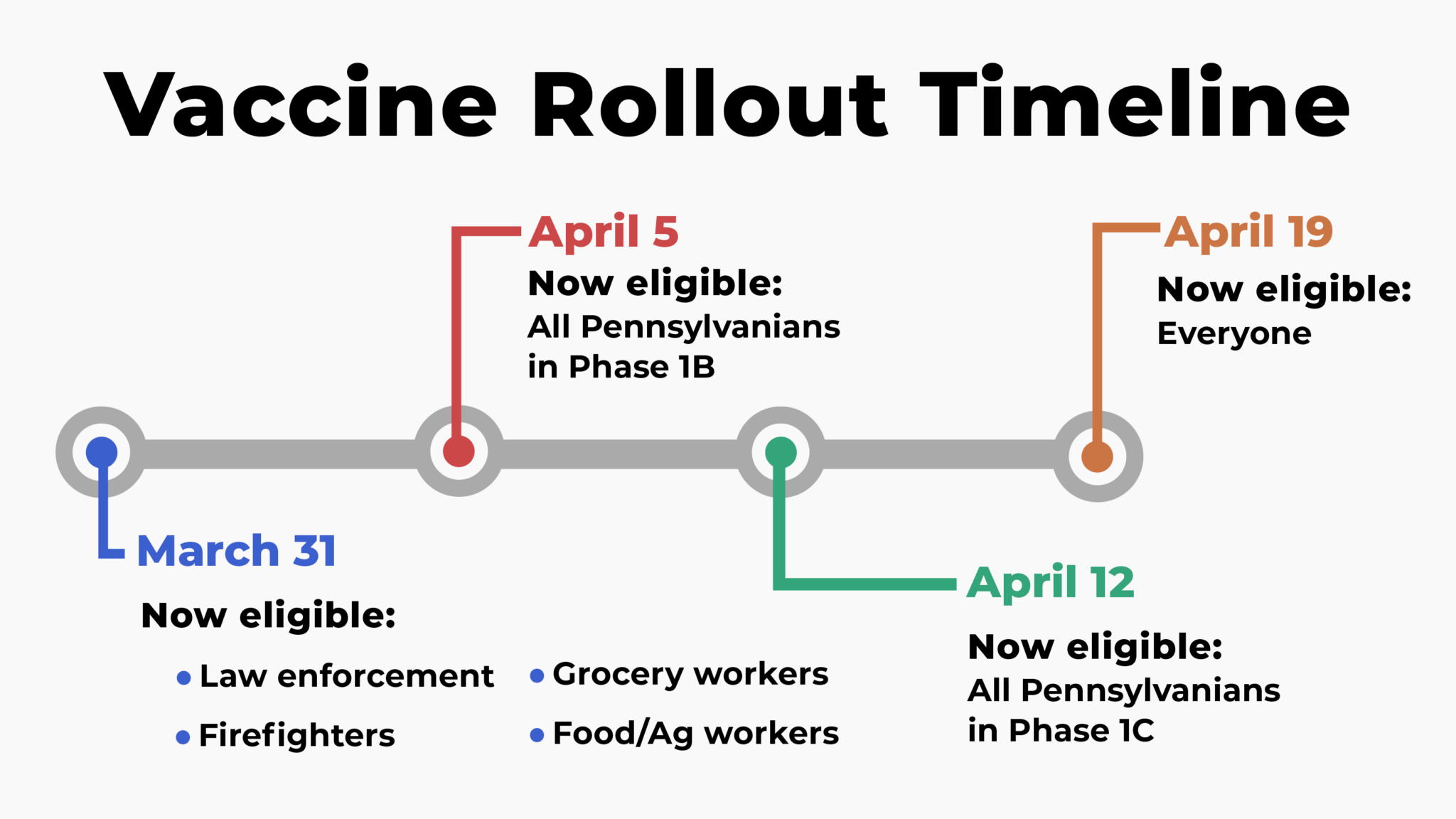

- On April 5, all Pennsylvanians in Phase 1B will be eligible for vaccine

- On April 12, all Pennsylvanians in Phase 1C will be eligible for vaccine

- On April 19, all remaining Pennsylvanians will become eligible

Learn more about what each phase means.

On March 3, 2021 FEMA will begin operating a large vaccine clinic at the Philadelphia Convention Center. The estimate is that the clinic will operate for 6 weeks and hopes to vaccinate 6,000 people per day.

This is not a walk up clinic and appointments are necessary and is for Philadelphia residents only. The people who will be invited are those who have expressed interest in getting the vaccine by signing up on the website www.phila.gov. It is the red banner that is about a 3rd of the way from the top. They are both emailing those with internet and calling those who do not to invite them. If folks don’t have internet access to sign up they can call 311 and they are able to register them from there. We are also able to register people as well.

The city continues to run clinics, hospitals, pharmacy partners and local health centers are also vaccinating people.

What do I need to know about the COVID-19 vaccine? Is the vaccine right for me?

-

See the City of Philadelphia COVID-19 Vaccine page for more information

-

There is no co-pay or charge for the covid-19 vaccine.

-

Insurance is not required to receive the vaccine.

-

There is no requirement for proof of citizenship in order to get the vaccine.

How can I sign up to get the vaccine?

Start by registering your interest with the City of Philadelphia by doing ONE of the following:

-

Filling out the Philadelphia Vaccine interest form

-

Or by calling the City’s COVID Call Center: (215) 685-5488 or calling 311

-

Or by emailing covid@phila.gov

Questions about the vaccine can be emailed to COVIDVax@Philly.gov

If you sign up with the city, you should receive a confirmation message.

Signing up with the city does not guarantee you an appointment for the vaccine. If you have an opportunity to receive a vaccine from another organization, please do so. If you see specific hospitals, pharmacies, or community sites offering their own vaccine interest forms, you can sign up for those as well. There is no limit to how many lists you can join.

Other places within West Philadelphia to sign up for the vaccine

The Black Doctors COVID-19 Consortium is hosting frequent vaccination sites for people who are eligible in the current phase and who live in the areas hardest hit by the pandemic, which include all of the ZIP codes in West Philly. See their website or social media, or call 484-270-6200 for more details and the most up-to-date information. March 8-12 they will be at Deliverance Evangelist Church, 2001 W. Lehigh Avenue, Philadelphia, PA 19132 from10am-4pm. From March 14-16, they will be at the Liacouras Center1776 N Broad Street, Philadelphia, PA 19121 from 10am-4pm. No appointment necessary (except for 2nd shot), must live in hardest-hit ZIP code, must be eligible for phase 1b.

-

Penn Medicine vaccine interest form

-

Main Line Health vaccine plan

-

University of the Sciences is hosting a regular vaccine clinic. They will call people who are eligible and who have signed up on the city’s interest form to invite them for an appointment.

-

FEMA (Federal Emergency Management Agency) is running a vaccine clinic at the Convention Center. They will call people who are eligible and who have signed up on the city’s interest form to invite them for an appointment.

I live in Philadelphia, when am I eligible to get the vaccine?

As of February 16, 2021, Philadelphia is vaccinating people eligible for phases 1A and 1B.

-

Click here to see a list of categories eligible in those phases.

-

Click here for Frequently Asked Questions about vaccine eligibility in Philadelphia.

-

Click here for more information on the city’s distribution plan.

-

Click here to see weekly updates on the city’s COVID-19 vaccine distribution. This a very helpful site!

Other resources about the covid-19 vaccine by state

COVID Alert PA

COVID Alert PA is the official mobile app by the Pennsylvania Department of Health (DOH) that uses the Exposure Notification System (ENS) provided by Apple and Google.

Download the App

You can now add your phone to the fight against COVID-19 by going to the Google Play Store or Apple App Store and downloading the free COVID Alert PA app to your smartphone. The app runs on iPhones that support iOS 13.5 and higher, and Android phones running Android 6.0 and higher. The app is not intended to be used by people under 18 years of age.

COVID-19

What is coronavirus?

Coronaviruses are a large family of viruses, some causing illness in people and others circulating among animals, including camels, cats and bats.

The 2019 novel coronavirus (COVID-19) is a new virus that causes respiratory illness in people and can spread from person-to-person. This virus was first identified during an investigation into an outbreak in Wuhan, China.

What are the symptoms of coronavirus?

Symptoms of the COVID-19 can include:

- Fever

- Cough

- Shortness of breath

The symptoms may appear in as few as two days or as long as 14 days after exposure. Reported illnesses have ranged from people with little to no symptoms to people being severely ill and dying.

How can the Coronavirus spread?

Human coronaviruses spread just like the flu or a cold:

- Through the air by coughing or sneezing;

- Close personal contact, such as touching or shaking hands;

- Touching an object or surface with the virus on it;

- Occasionally, fecal contamination.

How can I help protect myself?

If you are sick with COVID-19, or suspect you are infected with the virus, follow the steps below to help prevent the disease from spreading to people in your home and community:

- Stay home except to get medical care or necessary supplies

- Call ahead before visiting your doctor

- Separate yourself from other people and animals in your home

- Cover your coughs and sneezes

- Wash and sanitize your hands often

- Avoid sharing personal household items

- Clean all “high-touch” surfaces everyday

- Stop smoking. Those who smoke or vape are more likely to contract COVID-19 and symptoms will be more serious if they do.

- Monitor your symptoms

- Discontinue home isolation under the following conditions:

- At least 3 days (72 hours) have passed since recovery defined as resolution of fever without the use of feverreducing medications and improvement in respiratory symptoms (e.g., cough, shortness of breath); and,

- At least 7 days have passed since symptoms first appeared.

Useful Resources

General/Statewide:

- PA Department of Health

- Commonwealth of PA

- City of Philadelphia

- CDC

- Unemployment Compensation

- Complete the 2020 Census

- Information on Small Business Loans

- Tips on living with teenagers and young adults during quarantine

- Supporting families during Coronavirus (includes tips on children with disabilities)

Philadelphia

- Free Meal Locations

- City Department of Public Health’s recommendations for at-home cleaning

- Resources for families, including diapers and formula

- When and where to get tested

- Guidance for seniors and those with chronic diseases

- Philadelphia School District

- Applying to medical assistance as an Immigrant

- FAQ for immigrants applying for unemployment

Delaware County

Access to Medication

- Free service for anyone

- Registration: Patients/family can call local pharmacy or register through website

- Currently experiencing a delay if ordered online through website

- Any co-pays will need to be paid at time of order

- Medication Restrictions

Walgreens

- Free service for anyone

- Registration: Patients/family can call pharmacy, visit website or Text JoinRx to 21525 for delivery (also pick up)

- Medication Restrictions: controlled and test strips cannot be delivered

CVS

- Free service for anyone

- Registration: patient/family can sign up by calling local pharmacy or through website

- Medication Restrictions: Controlled, narcotics, nebulizers and insulin

CVS, Rite Aid and Walgreens located in West/Southwest Philadelphia

| CVS | ||

| Address | City/Zip Code | Phone # |

| 4000 Monument Rd 4849 Market Street 6900 Lindbergh Boulevard 4314 Locust Street 3925 Walnut Street 3401 Walnut Street, University Of Pennsylvania 6562 Haverford Avenue 7520 City Line Avenue |

Philadelphia, PA 19131 Philadelphia, PA 19139 Philadelphia, PA 19142 Philadelphia, PA 19104 Philadelphia, PA 19104 Philadelphia, PA 19104 Philadelphia, PA 19151 Philadelphia, PA 19151 |

267-233-5021 215-474-4801 215-365-5572 215-386-2093 215-222-0829 215-662-1333 215-748-3432 215-477-8401 |

| Walgreens | ||

| Address | City/Zip Code | Phone # |

| 300 N. 63rd St 3550 Market St |

Philadelphia, PA 19139 Philadelphia, PA 19104 |

215-476-2094 267-892-3107 |

| Rite Aid | ||

| Address | City/Zip Code | Phone # |

| 5440 Lansdowne Avenue 5040 City Line Avenue 5040 City Line Avenue 5627-99 Chestnut Street 4641-51 Chestnut Street 136 North 63rd Street 6731 Woodland Avenue 5214-30 Baltimore Avenue 4055-89 Market Street 1105-09 N. 63rd Street |

Philadelphia, PA 19131 Philadelphia, PA 19131 Philadelphia, PA 19131 Philadelphia, PA 19139 Philadelphia, PA 19139 Philadelphia, PA 19139 Philadelphia, PA 19142 Philadelphia, PA 19143 Philadelphia, PA 19104 Philadelphia, PA 19151 |

215-877-1506 833-423-7334 215-877-2116 215-474-1163 215-474-5447 215-472-7820 215-724-9677 215-476-1724 215-382-4260 215-879-1663 |

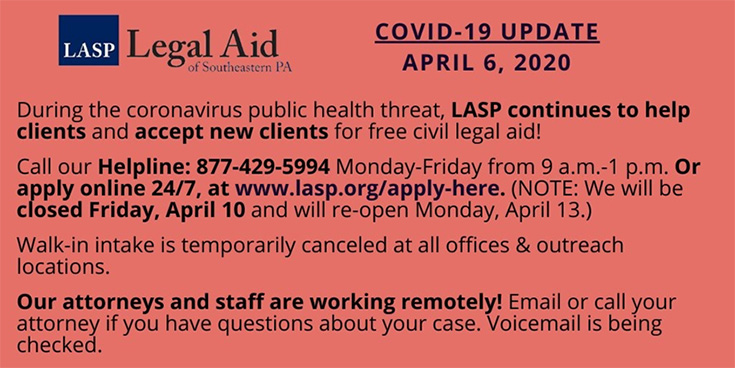

Legal Aid for Area Residents

For civil legal assistance, call their Helpline at 1-877-429-5994 Mon.-Fri. from 9:00 a.m. to 1:00 p.m. or visit lasp.org/apply-here. (The office will be closed Fri., April 10, and will reopen Mon. April 13.)

Walk-in services are currently unavailable due to the COVID-19 pandemic.

CDC Best Practices

What are the symptoms of coronavirus?

Symptoms of the COVID-19 can include:

- Fever

- Cough

- Shortness of breath

The symptoms may appear in as few as two days or as long as 14 days after exposure. Reported illnesses have ranged from people with little to no symptoms to people being severely ill and dying.

What to do if you think you have coronavirus COVID-19, according to the CDC:

- Stay home except to get medical care

- Separate yourself from other people and animals in your home

- Call ahead before visiting your doctor

- Wear a facemask if you are sick

- Cover your coughs and sneezes

- Clean your hands often

- Avoid sharing personal household items

- Clean all “high-touch” surfaces everyday

For more details on what to do prevent coronavirus COVID-19 spread, visit the CDCs full list of recommendations.